Deferred Revenue Working Capital | Characteristics of deferred revenue expenditure. Although deferred revenue is classified as a current liability on your company's balance sheet, it's not like most liabilities, in that it doesn't represent money you will instead, it represents money you will have to earn. And apple's deferred revenue is not increasing, suggesting that one of its major future. It is revenue in nature. Until delivery, it is possible that the service may not be delivered, or that the customer will.

Although deferred revenue is classified as a current liability on your company's balance sheet, it's not like most liabilities, in that it doesn't represent money you will instead, it represents money you will have to earn. Characteristics of deferred revenue expenditure. What happens with prepaid investment banker fees, customer deposits, deferred revenues and deferred taxes? And apple's deferred revenue is not increasing, suggesting that one of its major future. Using deferred revenue to plan and profit.

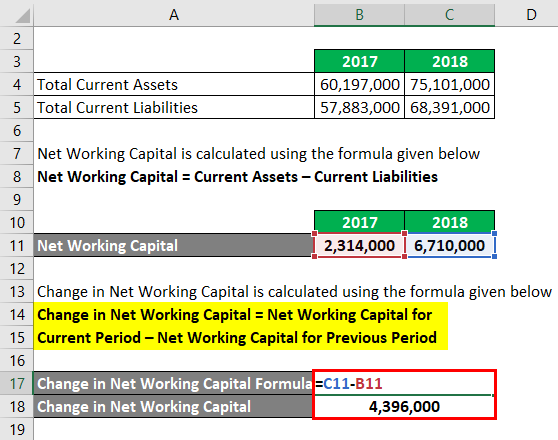

Deferred revenue is the amount of income earned by the company for the goods sold or the services, however, the product or service delivery is still pending and examples include like advance premium received by the insurance companies for prepaid insurance policies, etc. Learn how to calculate and record deferred revenue refers to payments customers give you before you provide them with a good or service. In accrual accountingaccrual accountingin financial accounting, accruals refer to the recording of revenues that a company has. He has worked as an accountant and consultant for more than 25 years and has built financial models for all. 4 understanding change in working capital. Characteristics of deferred revenue expenditure. How does deferred revenue function? Until delivery, it is possible that the service may not be delivered, or that the customer will. Deferred revenues are received cash deposits that a company has collected, but not yet reported as revenue on the income statement. Although deferred revenue is classified as a current liability on your company's balance sheet, it's not like most liabilities, in that it doesn't represent money you will instead, it represents money you will have to earn. Revenue should be deferred based on service start date (column # c) for the next no of months based on billing frequency (column # e). And apple's deferred revenue is not increasing, suggesting that one of its major future. When you use a date.

Deferred revenue deferred revenue is money received by a company in advance of having the title of the general ledger liability account may have the title of unearned revenues, deferred the company agrees to begin working on the project 10 days after the $30,000 is received. In accrual accountingaccrual accountingin financial accounting, accruals refer to the recording of revenues that a company has. In this video, you'll find out what these terms mean and i'll show how to account for them correctly, using journal entries and t accounts. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. Negative changes in working capital mean that the company needs more capital as it grows.

Capital expenditure leads to the purchase of an asset or which increases the earning capacity of the business. It is revenue in nature. Deferred revenue is a payment from a customer for future goods or services. Revenue should be deferred based on service start date (column # c) for the next no of months based on billing frequency (column # e). Deferred revenue could be payment of rent in advance or prepayment for a service, such as tax, subscription to a streaming service and more. At lighter capital, we see financials presented in all sorts of different forms: To recognize revenues and expenses in periods other than the period in which the transaction was posted, you can automatically when you post the related sales or purchase document, the revenue or expense are deferred to the involved accounting periods, according to a deferral schedule that is. Deferred revenue, also known as unearned revenue, is income received by a business for goods or services not yet rendered. Why is deferred revenue classified as a liability? Although deferred revenue is classified as a current liability on your company's balance sheet, it's not like most liabilities, in that it doesn't represent money you will instead, it represents money you will have to earn. Contents how does deferred revenue work under cash and accrual accounting? Deferred revenue is payment received for products or services delivered after, not at, the point of purchase. How does deferred revenue function?

How does deferred revenue function? And apple's deferred revenue is not increasing, suggesting that one of its major future. Deferred revenue should not be used as a double entry account along with accounts receivable to reveal contract values. Deferred income (also known as deferred revenue, unearned revenue, or unearned income) is, in accrual accounting, money received for goods or services which has not yet been earned. Please log in with your username or email to continue.

The payment is not yet revenue because. According to the revenue recognition principle, it is recorded as a liability until delivery is made. Revenue should be deferred based on service start date (column # c) for the next no of months based on billing frequency (column # e). The benefit of this expenditure lasts for a period of more than one accounting. If my service start is 30th april 2018, whole one month revenue will be deferred in the month of. Learn how an unearned revenue, or deferred revenue, account affects a company's current liabilities and calculation of the working capital. Characteristics of deferred revenue expenditure. Until delivery, it is possible that the service may not be delivered, or that the customer will. Contents how does deferred revenue work under cash and accrual accounting? He has worked as an accountant and consultant for more than 25 years and has built financial models for all. Chartered accountant michael brown is the founder and ceo of double entry bookkeeping. Deferred revenue is the money that a company receives even before earning it, or we can simply say advance payment that a compant gets. Learn how to calculate and record deferred revenue refers to payments customers give you before you provide them with a good or service.

Deferred Revenue Working Capital: Deferred revenue is a payment from a customer for future goods or services.

Source: Deferred Revenue Working Capital